International tax reforms are transforming the economic environment, affecting companies across the spectrum. For small enterprises, these reforms present a mix of challenges and opportunities. Unlike large corporations that can swiftly adjust due to their ample resources, small businesses typically function with limited budgets and reduced access to specialized advice, making the effects of tax reforms especially significant. This article explores the essential elements of international tax reforms, their effects on small enterprises, and approaches to successfully maneuver through the changing tax landscape.

Understanding Global Tax Reforms

Tax reforms generally seek to tackle challenges like economic disparity, tax evasion, and the enhancement of revenue streams. In recent times, international tax reforms have been motivated by the necessity to update antiquated systems in order to adapt to shifts in the global economy, including digital advancements and international trade.

Key Drivers of Global Tax Reforms

- Digital Economy and Taxation:

The emergence of technology giants and digital platforms has necessitated innovative strategies for taxing online transactions and intangible assets, including intellectual property. Initiatives such as the OECD’s Base Erosion and Profit Shifting (BEPS) project are designed to ensure that profits are taxed in accordance with the location of economic activity. - Combatting Tax Avoidance:

In response to profit shifting and offshore tax evasion, nations are enacting more stringent regulations. The introduction of minimum global tax rates, exemplified by the OECD’s proposed 15%, aims to create a more equitable tax environment. - Sustainability Goals:

To promote environmentally sustainable business practices, various green taxes and incentives are being introduced, impacting industries such as manufacturing and transportation.

Implications for Small Businesses

The effects of global tax reforms on small businesses vary depending on their size, industry, and geographic location. Here’s a breakdown of the key impacts:

1. Compliance Costs and Administrative Burden

Tax reforms frequently bring about new requirements for reporting and documentation. For small businesses with limited resources, adapting to these changes can be both time-consuming and financially burdensome. For example:

• Digital Sales Taxes: Companies selling products or services online may have to navigate a patchwork of tax regulations across different countries or states.

• Transfer Pricing Regulations: Small businesses involved in international trade must comply with intricate rules, often necessitating expertise that they may not possess.

2. Increased Tax Liabilities

Changes such as the introduction of minimum corporate tax rates and the curtailment of tax havens can result in increased tax obligations for small businesses. This is especially relevant for those that depend on low-tax jurisdictions to maximize profits. For instance:

• A small e-commerce enterprise exporting products to various countries may encounter heightened tax responsibilities due to new international tax agreements.

• Environmental taxes could raise expenses for businesses operating in energy-intensive sectors.

3. Opportunities Through Incentives

Not all reforms are negative. Numerous governments offer tax incentives aimed at fostering innovation, sustainability, and local job creation. Examples include:

• R&D Tax Credits: Small businesses that invest in research and development may qualify for tax deductions or rebates.

• Green Energy Subsidies: Shifting to renewable energy sources or implementing sustainable practices can alleviate tax pressures. By aligning their strategies with these incentives, small businesses can transform reforms into avenues for growth.

4. Competitive Disadvantages

Although global tax reforms aim to create a more equitable environment, small businesses frequently find it challenging to compete with larger corporations that benefit from economies of scale. For instance:

• A multinational corporation can invest in a dedicated team of tax experts to enhance its tax strategy, whereas a small business may not have access to similar financial resources.

• The compliance requirements associated with global standards can place a heavier burden on smaller enterprises, distracting them from their primary business functions.

Sector-Specific Impacts

1. E-Commerce and Digital Services

As digital marketplaces expand, numerous countries are implementing taxes on online transactions. Small e-commerce enterprises must adapt to new regulations, including value-added tax (VAT) on internationally sold digital products.

For instance, a small app development firm offering software subscriptions worldwide is now required to register for VAT in several jurisdictions, leading to increased complexity and expenses.

2. Manufacturing and Exporters

Manufacturers engaged in global supply chains may be impacted by tariffs, import/export duties, and carbon taxes designed to mitigate environmental effects.

For example, a small furniture manufacturer exporting to Europe could incur higher costs due to carbon border adjustment measures.

3. Startups and Innovation-Driven Businesses

Startups frequently take advantage of tax incentives aimed at fostering innovation, such as grants and research and development credits. However, they may also face challenges related to global tax regulations that necessitate comprehensive documentation and compliance.

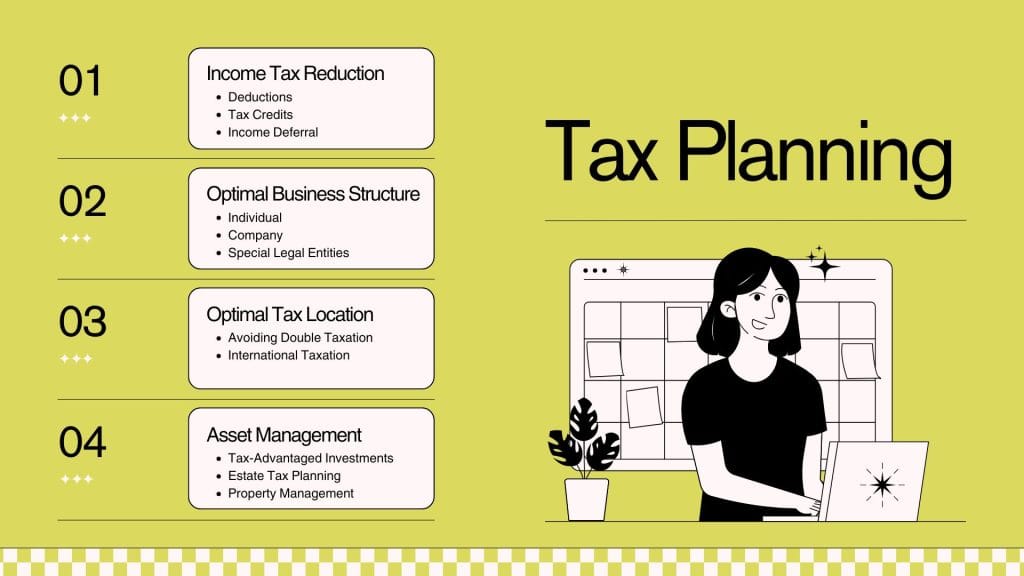

Strategies for Small Businesses to Navigate Tax Reforms

Adapting to global tax reforms requires a proactive approach. Here are strategies to help small businesses stay ahead:

1. Invest in Tax Expertise

Engaging a tax professional or consulting with an expert can help small businesses avoid expensive errors. Outsourcing tax compliance tasks can also allow more time to concentrate on growth.

2. Embrace Technology

Utilizing tax technology solutions, such as accounting software equipped with compliance tools, can streamline processes like tax calculation and reporting. Automation minimizes the risk of mistakes and ensures timely submissions.

3. Stay Informed

Consistently tracking changes in tax legislation is essential. Subscribing to updates from tax authorities or industry organizations can aid businesses in maintaining compliance.

4. Leverage Tax Incentives

Identify and utilize available tax credits, deductions, and grants for activities such as research and development, hiring, or implementing sustainable practices.

5. Plan for Higher Costs

Reforms may result in increased tax obligations. Small businesses should factor these potential expenses into their financial planning, ESTATE PLANNING, and pricing strategies to ensure long-term financial stability.

Global Examples of Tax Reform Impacts

1. The European Union’s VAT Rules

In 2021, the EU established new VAT regulations mandating that businesses selling products to EU consumers collect VAT at the time of sale. This reform removed the VAT-free threshold for small enterprises, thereby heightening compliance obligations.

Impact: A small craft business in the UK selling to EU clients is now required to register for VAT within the EU, leading to increased administrative expenses.

2. The U.S. Corporate Tax Reforms

The U.S. enacted substantial modifications through the Tax Cuts and Jobs Act of 2017, which included a lowered corporate tax rate and revised international taxation rules. While some small enterprises enjoyed the benefits of reduced rates, those involved in international trade encountered additional complexities.

Conclusion

Global tax reforms offer a blend of challenges and opportunities for small businesses. While the concerns regarding compliance costs and increased liabilities are significant, these reforms also create avenues for new incentives and growth opportunities. By staying updated, utilizing technology, and seeking professional advice from Zari Financials, small businesses can not only endure but also prosper in the changing tax environment. Proactive planning and flexibility are essential for transforming these reforms into opportunities for long-term success.